Breakdown:

Goldman Sachs Research predicts that European stocks will experience an upturn in 2025, despite the challenges posed by political and trade uncertainties, as well as sluggish economic growth within the region.

Market Index (STOXX 600)

The STOXX 600 index, which encompasses companies from Europe and the UK, is anticipated to yield a total return of approximately 9% next year (as of November 19, 2024). This projection is slightly below big banks forecasts for its counterparts in the US and Asia.

To gain insight into the equity outlook for Europe in 2025, we spoke with Sharon Bell, a senior strategist at Goldman Sachs Research. Report, titled “2025 Outlook: Peer Pressure,” indicates a slight reduction in their forecasts for the STOXX 600 for the upcoming year. Bell highlights potential benefits for European stocks stemming from easing inflation, a more robust-than-expected response from European policymakers, or investor concerns regarding returns from large-cap US stocks.

What prompted the team to revise their target prices for the STOXX 600 for the coming year?

We hold a more cautious view on growth: Recent months have seen us lower our economic forecasts and earnings expectations for Europe. In light of this, our price targets have also been adjusted downward, albeit marginally.

Furthermore, there has been a modest increase in perceived risks. The fiscal stability in countries like France, Italy, and to a lesser extent the UK, is under scrutiny. Economic indicators have been lackluster, particularly impacting Germany due to a troubling manufacturing cycle.

While the current situation does not indicate a recession—it’s far less severe than what was witnessed during the financial crisis, sovereign debt crisis, or pandemic—the downgrade is nonetheless warranted due to a buildup of risks alongside weaker growth projections.

What sectors are you optimistic about in the European stock market?

We foresee a decline in interest rates by the European Central Bank, potentially reaching 1.75% by mid-next year, down from 3.25% in October. This reduction is likely to unlock opportunities in heavily indebted sectors such as telecommunications, as well as in interest-sensitive areas like real estate.

Consumer-facing industries, including retail and travel, are expected to show resilience. These sectors will benefit not only from lower interest rates but also from their focus on domestic consumers, insulating them from trade tensions and tariffs.

Furthermore, smaller companies may experience significant advantages from declining rates. Typically, these firms carry more debt and often have floating-rate loans, making them particularly sensitive to interest rate changes.

Additionally, we anticipate an uptick in merger and acquisition (M&A) activity, which can further support small and mid-sized enterprises in the market. Overall, the combination of lower rates and increased M&A activity presents a favorable outlook for stocks in Europe.

Impact of Global Economic growth

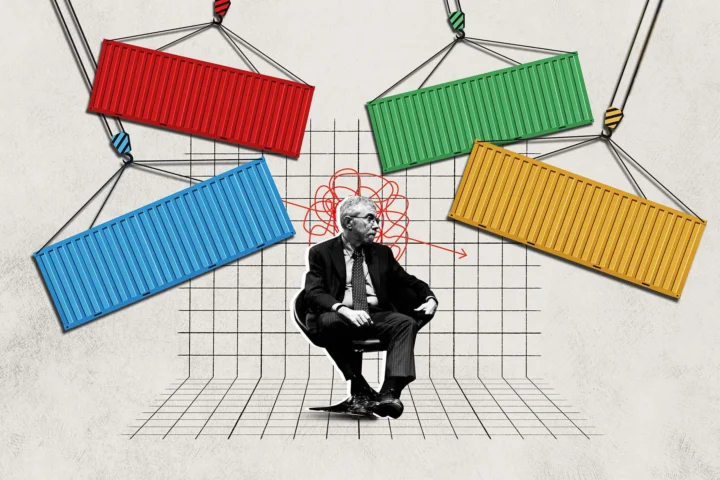

When evaluating economic performance, the question of which region is most critical for European companies— the US, the EU, or China—remains a focal point for investors. Currently, our outlook on European growth appears weak, contrasting with a more optimistic view on the US economy. Additionally, we anticipate that China will implement stimulus measures that could bolster growth in the coming year.

Despite most European companies generating their sales within Europe, this domestic segment has stagnated over the past two decades. Consequently, growth for these firms has increasingly relied on sales from the US and China.

We favor stocks with significant exposure to the US market for several reasons. First, these companies benefit from a robust economic environment, which typically translates into improved sales and earnings over time. Second, as dollar earners, they stand to gain from a stronger dollar. Finally, while corporate taxes in Europe are on the rise, the tax landscape in the US may present more favorable conditions for growth. This dynamic underscores the importance of looking beyond Europe to understand the broader market potential for European companies.

The strong performance of US equities over the past year has significantly impacted European stocks. The US market has consistently outperformed its European counterparts across various time frames, including the last month, three months, six months, and even the past few years. This trend has led to substantial fund inflows into US markets, while European allocations have remained relatively stagnant.

Given this dynamic, investors are increasingly questioning whether a reversal is on the horizon. The remarkable rally in US stocks, particularly post-election, raises concerns about high valuations, which may render the US market more vulnerable. As a result, Europe is becoming a more intriguing option for investors seeking alternatives.

Several factors could potentially catalyze a turnaround for European stocks, such as significant policy easing, a peace agreement in Ukraine, or an uptick in manufacturing activity. However, these developments do not align with our core market outlook at this time. Thus, while the European stock market presents opportunities, caution remains warranted as investors navigate this evolving landscape.

Lastly, another factor that could benefit EU’s stock market would be a negative sentiment surrounding American markets: overall performance or issues facing multi-nationals. One of these could be lead by the overspending in CAPEX by large tech corporations. If investors start questioning those investment’s returns, then that could push EU’s stocks (on a relative basis).