Discover why global investors are pivoting their portfolios beyond U.S. technology stocks in 2025. Learn about emerging opportunities in India, Japan, and East Asian markets as the global economic landscape shifts.

The Shifting Sands of Global Investment

As we venture into 2025, a fascinating transformation is reshaping the global investment landscape. While U.S. technology stocks have dominated headlines and portfolios for years, savvy investors are now identifying compelling opportunities in unexpected corners of the global market. The MSCI AC World Index’s impressive 20% return through November 2024 tells only part of the story – beneath the surface, a more nuanced narrative is emerging.

The ongoing bull market, now entering its third year since the September 2022 lows, shows no signs of exhaustion. However, its character is evolving. Corporate earnings are increasing across sectors, suggesting we’re entering a new phase where market gains may be more evenly distributed. This evolution presents both opportunities and challenges for investors seeking to position their portfolios for 2025 and beyond. Has capital is distributed across the globe Forex volume is likely to increase. This flow is also going to provide capital to business in emerging markets.

India: The Emerging Powerhouse

Perhaps the most compelling story in global markets is unfolding in India. With projected real GDP growth of 7% in 2025 and corporate earnings expected to surge by 16.5%, India represents a rare combination of scale and growth. The MSCI India Index’s forward P/E ratio of 22 might appear steep compared to broader emerging markets, but it reflects India’s unique position as a beneficiary of global supply chain diversification and domestic consumption growth.

The AI Revolution’s Hidden Champions

While much attention has focused on U.S. technology giants, the real beneficiaries of AI’s next phase may be found in East Asia. Taiwan and South Korea, home to the world’s largest semiconductor manufacturers, are positioned to capture growing demand for AI infrastructure. Korean equities, trading at just 7.6 times forward earnings, offer particularly attractive valuations for investors seeking exposure to this technological revolution.

Japan’s Renaissance

Japan’s economy is experiencing its strongest nominal GDP growth in decades, with projections of 3.5% growth in 2025. Trading at 15 times forward earnings, Japanese equities offer an attractive entry point into a market undergoing significant corporate reform. The Tokyo Stock Exchange’s push for improved governance and returns on equity could unlock significant value in previously resistant sectors like retail, telecoms, and financials.

Brazil: A Contrarian Opportunity

Despite underperforming global markets by 38% over the past two years, Brazil presents an intriguing opportunity for value investors. With consensus forecasts pointing to 15% earnings growth in 2025 and valuations at just 7 times forward earnings, Brazilian equities offer significant upside potential as the country’s fiscal reforms take hold.

Investment Implications for 2025

The data presents a clear picture: global market leadership is diversifying. While U.S. markets maintain their importance, the most attractive risk-adjusted returns may lie elsewhere. Consider these key metrics:

- India’s projected 16.1% earnings growth for 2026

- Japan’s attractive 15.2x forward P/E ratio

- Brazil’s compelling 9.3x forward P/E ratio with 15% earnings growth potential

- East Asian markets’ 14.2% forecast earnings growth

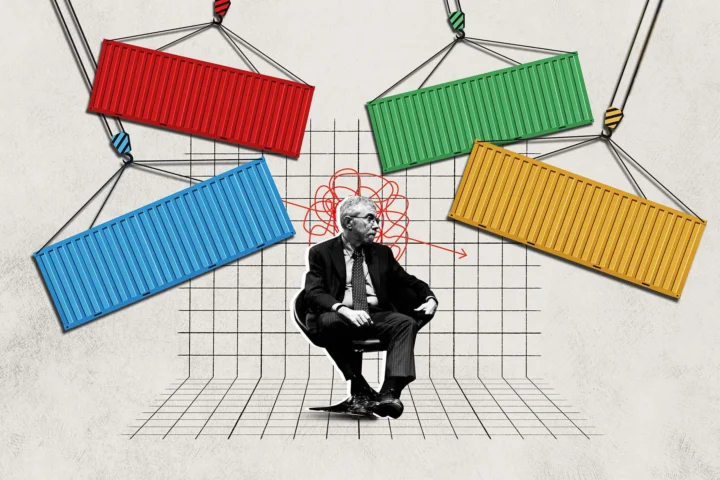

Managing Risks in a Changing Landscape

Of course, this evolving landscape isn’t without risks. U.S. fiscal policy under the incoming Trump administration, potential trade tensions, and varying regional inflation rates could all impact market performance. However, these risks appear at least partially priced into valuations outside the U.S.

The Path Forward

For investors, 2025 presents a rare opportunity to reposition portfolios for a changing world. While maintaining core positions in U.S. markets remains prudent, the data suggests that selective exposure to international markets could enhance returns and provide valuable diversification.

As we navigate this transition, remember that market leadership shifts are often gradual, then sudden. The current valuations in markets like Japan, Brazil, and South Korea suggest that patient investors who position themselves ahead of these changes may be well rewarded.

The end of U.S. technology dominance doesn’t mean the end of opportunities – rather, it signals the beginning of a more nuanced and potentially more rewarding investment landscape for those willing to look beyond the obvious choices.

This analysis is based on Citi Bank’s comprehensive market outlook and supported by current market data. As always, investors should conduct their own research and consider their individual risk tolerance before making investment decisions.