Introduction

- Focus: The article provides economic insights and views on various asset classes, such as stocks, bonds, and the US dollar, going into 2025.

Key Highlights

- US 10-Year Yields: Entering 2025, the yields are attractive after four years of rising yields.

- Growth and Inflation Risks: Risks are no longer skewed to the upside, with the market adjusting expectations.

- Policy Implications: The incoming administration’s policies are expected to be less inflationary, and the Fed’s reaction to tariffs is likely less hawkish.

- Investment Stance: Favoring stocks and bonds, with selective US dollar exposure to hedge against hawkish Fed repricing or tariff increases.

Economic Context

Performance of US Yields in 2024

2024 marked a significant period for US yields, as it was the fourth consecutive year of rising US 10-year yields—a phenomenon not seen since the early 1980s. This prolonged increase in yields highlighted the market’s ongoing adjustments to economic conditions and monetary policies. The sustained rise in yields was driven by several factors, including robust economic growth, inflationary pressures, and the Federal Reserve’s monetary tightening.

Consensus Economic Growth Expectations

In 2023 and 2024, consensus economic growth expectations were notably lower than the actual performance of the economy. Economists underestimated the strength of several key factors:

- Private Sector Balance Sheets: Private sector entities, including businesses and households, maintained strong balance sheets. This financial stability enabled continued investment and spending, even in the face of rising interest rates.

- Income Growth and Consumption: Strong income growth supported consumer spending. A significant boom in immigration also contributed to this dynamic, as increased population growth bolstered demand for goods and services.

- Fiscal Policy Support: Extended fiscal policy measures provided additional support to the economy. These measures included government spending programs and tax incentives that helped sustain economic activity.

Current Growth Expectations for 2025

As we enter 2025, the consensus expectation for real GDP growth is 2.2%. While positive real incomes and resilient consumption might continue to support growth above this number, the scope for upside surprises compared to expectations has diminished. The economy is not expected to perform as robustly as in previous years, but a recession is also considered unlikely.

Cooling Labor Market

Several indicators suggest a cooling labor market, despite strong headline payroll data:

- Household Survey: This survey reflects broad labor market conditions, including employment levels, job openings, and quit rates.

- Job Openings and Labor Turnover Survey (JOLTS): This survey measures job vacancies, hires, and separations. A decline in job openings and an increase in job separations indicate a cooling labor market.

- Continuing Claims for Unemployment Benefits: Rising claims suggest that more people are remaining unemployed for extended periods.

Struggles in Residential Activity and Business Spending

- Residential Activity: The housing market continues to face challenges due to elevated mortgage rates. High borrowing costs make home purchases more expensive, leading to reduced demand for housing.

- Business Spending: Investment in business activities has weakened. This includes reductions in capital expenditures, such as equipment and infrastructure investments.

Inflation Trends

The overall trend of inflation appears to be downward, with some exceptions:

- Core Personal Consumption Expenditures (PCE): While there were upside surprises in core PCE in September and October 2024, the underlying trend is toward lower inflation. The November print annualized under 2%, contributing to evidence that shelter prices are decelerating.

- Shelter Prices and Wages: The three-month moving average of core PCE stands at 2.5%, indicating ongoing progress toward the Federal Reserve’s 2% target. Cooling in shelter prices and wages supports this trend.

Balanced Outlook for Growth and Inflation

As we enter 2025, the risks to consensus growth expectations are more balanced than they have been in this economic cycle. The market is pricing in a Federal Reserve that is nearing the end of its easing campaign. The potential for significant tariff increases or restrictive immigration policies under the new administration adds to the complexity of the economic outlook. However, the overall risk-reward scenario for government bonds and selective credit exposure has improved, given the more balanced outlook for growth and inflation.

Growth and Inflation Outlook

Labor Market: Cooling Labor Market

Despite strong headline payroll data, the labor market is showing signs of cooling. Various indicators, such as household surveys, quits, job openings, and continuing claims, suggest that the pressures in the labor market are easing. This means that while the overall number of jobs might still be high, the underlying data indicates that the job market is not as tight as it once was.

Residential Activity: Struggling Amid High Mortgage Rates

The residential real estate market continues to face challenges. High mortgage rates have made it difficult for potential buyers to afford homes, leading to a slowdown in housing activity. This has resulted in reduced demand for new homes and has put pressure on home prices. The struggle in the housing market is a key factor in the overall economic outlook.

Business Spending: Weakened

Business spending has shown signs of weakening. Companies are becoming more cautious with their investments and expenditures. This cautious approach is likely due to uncertainties in the economic environment and higher borrowing costs. The decline in business spending can impact overall economic growth, as businesses hold back on expansion and capital projects.

Inflation Trend: Generally Downward

The trend in inflation has been generally downward, despite some bumps in 2024. Core Personal Consumption Expenditures (PCE), which is a key measure of inflation, has shown a gradual decline. The recent data suggests that inflation is moving towards the 2% target, although the path to this target may be uneven. Lower inflation is generally positive for the economy as it helps maintain purchasing power and supports consumer confidence.

In summary, the growth and inflation outlook indicates a cooling labor market, struggling residential activity, weakened business spending, and a generally downward trend in inflation. These factors combined paint a picture of an economy that is stabilizing but facing several challenges.

Federal Reserve’s Easing Campaign

The Federal Reserve’s easing campaign, also known as monetary easing or quantitative easing (QE), involves the central bank purchasing financial assets to inject liquidity into the economy. This is done to lower interest rates, encourage borrowing, and stimulate economic growth. The Fed typically buys government bonds and other securities, which increases their prices and lowers their yields. This makes borrowing cheaper for businesses and consumers, potentially boosting investment and spending. However, it can also lead to concerns about inflation and asset bubbles.

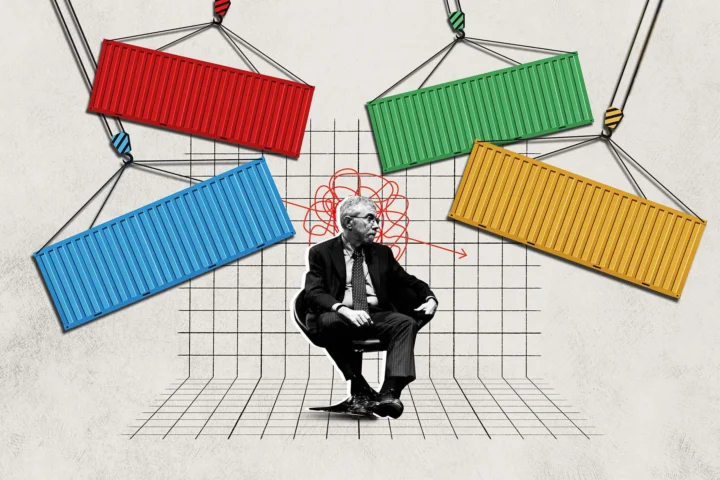

Impact of Tariffs

Tariffs are taxes imposed on imported goods and services. They are used to protect domestic industries from foreign competition, raise government revenue, and sometimes to retaliate against unfair trade practices. While tariffs can benefit certain domestic industries by making imported goods more expensive and less competitive, they can also lead to higher prices for consumers, reduced export opportunities for domestic companies, and potential trade wars. The overall impact of tariffs on the economy depends on factors such as the specific industries targeted, the size of the tariffs, and the responses of trading partners.

Immigration Policies

Immigration policies determine who can enter a country, how long they can stay, and what rights and privileges they have. These policies can have significant economic, social, and cultural impacts. For example, more restrictive immigration policies can lead to labor shortages in certain industries, while more open policies can contribute to economic growth by bringing in skilled workers and entrepreneurs. Immigration policies also affect the demographic composition of a country, which can have long-term implications for social services, education, and healthcare systems.

Fiscal Risks and Policies

Fiscal Risks

Fiscal risks refer to the potential for unexpected changes in government finances due to various factors. These can include economic shocks, natural disasters, changes in commodity prices, and financial crises. Effective fiscal risk management involves identifying, monitoring, and mitigating these risks to ensure fiscal stability and sustainability. The International Monetary Fund (IMF) provides a comprehensive toolkit to help countries manage fiscal risks, emphasizing the importance of transparent reporting and effective risk management.

Trump’s Fiscal Agenda

President-elect Donald Trump’s fiscal agenda includes a mix of tax cuts, increased government spending, and regulatory changes. Key components of his agenda are extending the Tax Cuts & Jobs Act, introducing new tax breaks, and increasing tariffs. Trump’s fiscal policies aim to stimulate economic growth, but they also raise concerns about increasing the federal deficit and potential inflationary pressures.

Yield Curve and Term Premia

The yield curve represents the relationship between interest rates and the maturity of debt securities, typically government bonds. A normal yield curve slopes upward, indicating higher interest rates for longer-term bonds. The term premium is the additional yield that investors require for holding longer-term bonds, compensating for the risk of interest rate changes over time. The Federal Reserve uses models to estimate term premia, which help in understanding market expectations and the compensation investors demand for interest rate risk.

Asset Allocation

Overall Asset Class Views

| Stocks | 📈 |

| Bonds | 📈 |

As we move into 2025, our asset allocation strategy remains optimistic for both stocks and bonds. Although equities are not particularly cheap, the combination of decent growth, healthy earnings, disinflation, and ongoing global monetary easing provides a strong tailwind for risk assets. US Treasuries, meanwhile, offer attractive yields and serve as a primary hedge against downside risks in growth. Credit, especially US corporate bonds, is more focused on carry than price appreciation, with historically narrow spreads and attractive all-in yields.

Global Equities

The outlook for global equities remains constructive, driven by strong earnings, less sensitivity to manufacturing disruptions, and favorable financial conditions. The US equity market benefits from a robust earnings profile and potential for deregulation, though the strengthening US dollar may pose challenges. In contrast, European equities struggle due to a weaker economy and lower earnings, despite cheap valuations. Japan continues to see solid earnings and higher nominal growth, countered by tightening from the Bank of Japan. Emerging Markets face support from policy shifts but remain vulnerable to tariff risks and US dollar strength.

Global Government Bonds

Valuations in global government bonds have improved, making duration more attractive. We expect growth and inflation to decelerate this year, supporting a global easing cycle, with the exception of Japan. US Treasuries stand out due to attractive valuations and expectations of moderating inflation and growth. European Bunds benefit from persistently weak growth and slowing inflation, while UK Gilts are influenced by a large budget deficit and increased fiscal spending. Japanese Government Bonds face accelerating wages and underlying inflation, while Swiss bonds are historically expensive due to substantial easing priced into the Swiss National Bank’s policies.

Global Credit

The risk-reward outlook for global credit is less compelling, particularly in the US, where spreads are at their tightest levels since before the Global Financial Crisis. However, EUR and Asia high yield markets continue to offer attractive carry opportunities. Investment grade credit remains appealing for income-seeking investors, with returns driven by carry and duration. High yield credit, while justified by good credit quality and a supportive macro backdrop, offers modest compensation for downside risks. Emerging Market Debt in hard currency presents lower default risk and attractive spreads, though rising US yields and a strong US dollar pose significant risks.

FX (Foreign Exchange)

| EUR/JPY | 📉 |

| CHF | 📉 |

The US dollar is expected to remain strong due to US exceptionalism and tariff risks, outperforming both low and high yield currencies. The euro faces persistent weakness due to relative growth and rate differentials, as well as tariff risks. Japanese yen is favored on a relative basis against the euro and Chinese yuan, given its cheap valuations and Bank of Japan tightening. The Swiss franc is likely to weaken due to more aggressive cuts from the Swiss National Bank and expensive valuations. Among emerging market currencies, the South African rand is overweighted for carry and positive domestic reform, while the Chinese yuan is underweighted due to tariff risks.

Commodities

Gold continues to be an attractive diversifier with strong structural support. With OPEC+ delaying output increases, the downside risk for oil has been removed, and we expect Brent crude oil to trade between USD 70-80 per barrel. This range reflects a balanced outlook for supply and demand dynamics in the oil market.

Asset allocation summary table

The following table showcases the stance on each asset class.

| Asset Class | View | Comments |

|---|---|---|

| Global Equities | ↑↑ | Constructive macro and earnings backdrop; elevated valuations; favorable financial conditions. |

| US Equities | ↑ | Strong earnings profile; less manufacturing sensitivity; potential for deregulation. |

| European Equities | ↓ | Struggling economy and earnings; cheap valuations. |

| Japanese Equities | ↔ | Solid earnings; higher nominal growth; Bank of Japan tightening. |

| Emerging Markets Equities | ↓ | Supported by policy shifts; tariff risks and USD strength challenges. |

| Global Government Bonds | ↑ | Improved valuations; decelerating growth and inflation supports a global easing cycle. |

| US Treasuries | ↑↑ | Attractive valuations; expectations of moderating inflation and growth. |

| European Bunds | ↑ | Weak growth; slowing inflation; tariff risks. |

| UK Gilts | ↔ | Large budget deficit; near-term fiscal spending offsets cheap valuations. |

| Japanese Government Bonds | ↓ | Accelerating wages and underlying inflation; overpricing of accommodative policy. |

| Swiss Bonds | ↓ | Historically expensive; substantial further easing priced into SNB policies. |

| Global Credit | ↔ | Tightest spreads since the Global Financial Crisis; EUR and Asia HY offer carry opportunities. |

| Investment Grade Credit | ↔ | Income opportunities in credit; returns driven by carry and duration. |

| High Yield Credit | ↔ | Good credit quality; supportive macro backdrop; modest compensation for downside risks. |

| EMD Hard Currency | ↔ | Lower default risk; attractive spreads; risks from rising US yields and strong USD. |

| FX (Foreign Exchange) | ↔ | USD strength due to exceptionalism and tariffs; weakness in EUR; potential in JPY vs. EUR/CNH. |

| Commodities | ↑ | Gold as an attractive diversifier; Brent crude oil trading between USD 70-80. |

Conclusion

In summary, our asset allocation strategy for 2025 emphasizes a balanced approach with a positive outlook for both equities and bonds. While we navigate potential risks such as accelerating inflation and a more hawkish Federal Reserve, we remain cautiously optimistic about the opportunities available in global markets. By carefully managing these risks and maintaining flexibility in our portfolio construction, we aim to achieve resilient and sustainable returns for our clients.