Discover how elite traders use the Contrarian Positioning Index to profit from retail trader mistakes. Learn the psychology behind market reversals and how to spot high-probability trading opportunities using sentiment analysis.

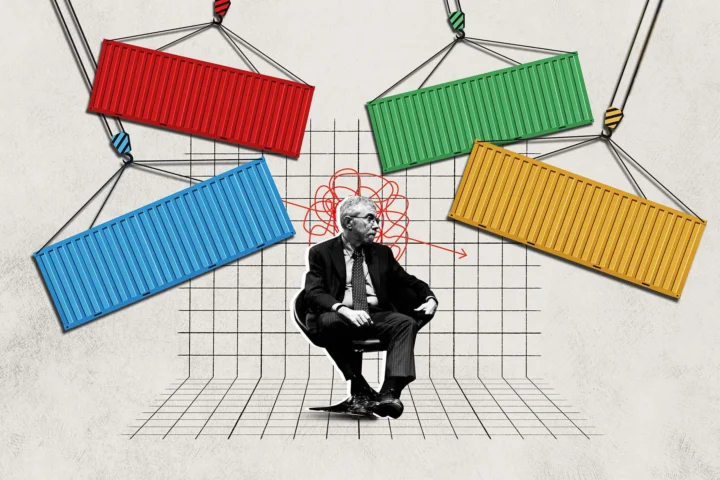

The Hidden Truth Behind Market Moves

The most painful lesson in forex trading often comes from being right about the market direction but still losing money. If you’ve ever wondered how this happens, you’re about to discover one of trading’s most fascinating paradoxes – the power of trading against the crowd.

Understanding the Crowd’s Crystal Ball

Imagine knowing exactly what thousands of retail traders are doing with their money right now. Better yet, imagine knowing that when these traders overwhelmingly agree on a market direction, they’re usually wrong. This is the essence of the Contrarian Positioning Index, a powerful tool that has transformed how successful traders view market opportunities.

The Birth of Sentiment Trading

The story begins with a simple observation made by major forex brokers: retail traders tend to cluster their positions in the same direction, especially at market extremes. This behavior created an opportunity for institutional traders, who began systematically taking the opposite side of these retail positions. Today, thanks to publicly available data from brokers like IG Markets and platforms like Myfxbook, we can tap into this same institutional edge.

Inside the Mind of the Market

Understanding the index starts with grasping its foundation. Major brokers aggregate real-time positioning data from their retail client base, showing the percentage of traders who are long versus short on any given currency pair. This raw data transforms into actionable intelligence when we understand the psychology behind it.

When Extremes Signal Opportunity

The magic happens at the extremes. When retail sentiment reaches levels above 75% in either direction, something remarkable tends to occur. The market frequently reverses, punishing the majority and rewarding the contrarian minority. This isn’t random – it’s a reflection of how large institutional players deliberately position themselves against retail crowd behavior. Their big positions need liquidity in order to fill at good prices. You can see retail traders and other market participants as being the fishes and the big FX trading bnks as the net that will swoop them.

Real Money, Real Examples

Consider what happened during a recent EUR/USD movement. As the pair approached 1.0800, retail sentiment data showed an astonishing 82% of traders were betting on further declines. The conventional wisdom suggested the euro was weak and destined to fall further. Yet, professional traders saw something different in these numbers – they saw opportunity.

Beyond the Numbers

Trading with sentiment requires more than just watching numbers. It’s about understanding market psychology and the forces that drive major moves. When you see extreme sentiment readings, you’re really seeing a snapshot of market psychology at its most vulnerable point.

Think of sentiment extremes as a loaded spring. The more traders pile into one direction, the more energy builds up for a potential reversal. However, timing is crucial. Successful traders don’t simply take trades against the crowd – they wait for confirmation.

Building Your Sentiment Edge

The real power of sentiment analysis comes from understanding its limitations. It’s not a crystal ball that predicts exact turning points. Instead, it’s a tool that helps you understand when market conditions are ripe for a reversal. Combined with proper risk management and patience, it becomes a powerful edge in your trading arsenal.

Applying Sentiment to your trading

The first thing you will need is the data sources. The main provider for such data used to be DailyFx, however since September of 2024 it has shut down….

But there are still some other data aggregators that allow you to access this valuable data for FREE. Bookmark them!

As an exemple we will use MyFxBook (first link above). Here is what EUR/USD looks like:

First thing we can see is the downward trend of the EUR/USD. For the past two years it has been strongly falling.

The second thing I look at is the quantity of Longs vs. Shorts. In this case we can see that the Longs are still outweighing shorts. As long as longs are “active” the trend is likely to remain downward. That is why in my shorter timeframe analysis I will only look for short setups. I would have started to look for longs as soon as the retail market is starting to become short (ie: Short lots is > Long lots).

Keep in mind that this is only one component of the overall analysis. While it is powerfull, there are still other market influencing factors, like economics data, geopolitics. Alliging both becomes a super weapon in trading and nothing can stop you.

I hope this article was benefitial for your trading.

Cheers,

Alex Chislaru