2025 is already looking juicy in terms of macro economic data.

The United States is heading toward another debt ceiling confrontation, but this time with a unique twist that could create significant opportunities in the forex market. Let’s break down what’s happening and understand how it might affect your trading decisions.

Understanding the Current Situation

Treasury Secretary Janet Yellen has just sounded an alarm that every currency trader should hear. The debt ceiling, which is essentially America’s credit limit, will become active again on January 2, 2025. Think of it as a national credit card that’s about to hit its limit right after the holiday shopping season.

The Critical Timeline

The situation becomes particularly interesting between January 14-23, 2025. During this period, the United States could potentially face a technical default if Congress doesn’t take action. Imagine if the world’s largest economy suddenly couldn’t pay its bills – the ripple effects across currency markets would be substantial.

How This Affects Major Currency Pairs

EUR/USD

When debt ceiling tensions rise, the EUR/USD typically experiences increased volatility. During previous debt ceiling crises, we’ve seen this pair move in counterintuitive ways:

- Initial dollar weakness as uncertainty grows

- Sudden strengthening when resolution appears close

- Sharp swings during political negotiations

USD/JPY

The Japanese Yen often serves as a safe-haven currency during U.S. political uncertainty. During debt ceiling crises, we typically see:

- Strengthening Yen as investors seek safety (if you want to know more about our preditions for USD/JPY check out our analysis)

- Increased correlation with U.S. Treasury yields

- Higher volatility during Asian trading sessions

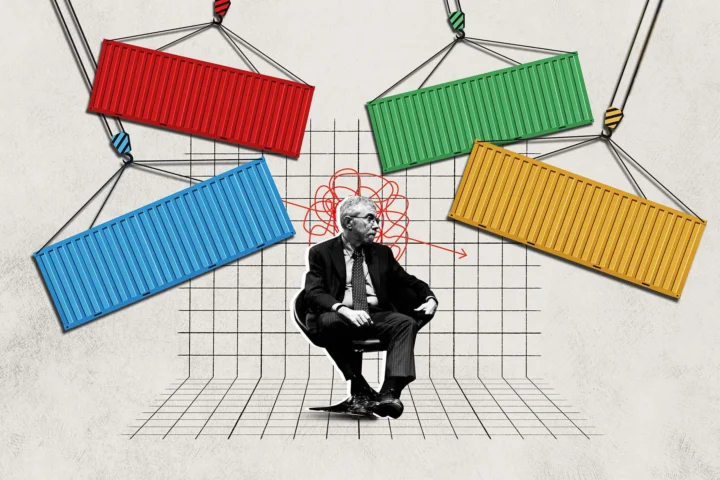

Trump’s Influence and Market Implications

President Trump’s return to office adds a fascinating dimension to this situation. His stated desire to eliminate the debt ceiling entirely creates an interesting dynamic:

- Short-term Market Impact

- Increased volatility as markets digest political rhetoric

- Potential dollar weakness during negotiation periods

- Risk-off movements benefiting safe-haven currencies

- Long-term Considerations

- Questions about fiscal discipline

- Potential impact on U.S. credit rating

- Structural changes to how markets view U.S. debt

Trading Strategies During the Crisis

For Conservative Traders

Consider implementing these risk management techniques:

- Reduce position sizes during key negotiation periods

- Set wider stops to account for increased volatility

- Focus on major pairs with higher liquidity

For Aggressive Traders

Look for opportunities in:

- Short-term volatility trading during Congressional sessions

- News-based momentum trades

- Safe-haven currency pairs during peak uncertainty

The “Extraordinary Measures” Playbook

When Yellen mentions “extraordinary measures,” she’s referring to emergency actions the Treasury can take to prevent default. For traders, these measures typically create predictable market patterns:

- Initial Announcement Phase

- Dollar typically weakens

- Safe-haven currencies strengthen

- Emerging market currencies face pressure

- Implementation Phase

- Market volatility increases

- Intraday trading ranges expand

- Correlation between USD pairs strengthens

Key Dates for Your Trading Calendar

- January 2, 2025: Debt ceiling reinstates

- January 14-23, 2025: Critical default risk window

- Early February 2025: Potential exhaustion of extraordinary measures

Risk Management Essentials

During this period, consider these enhanced risk management strategies:

- Position Sizing

- Reduce standard position sizes by 25-50%

- Consider splitting larger trades into smaller lots

- Maintain higher cash reserves for margin requirements

- Stop Loss Placement

- Use wider stops to account for increased volatility

- Consider using options as protection where available

- Implement trailing stops to protect profits

Market Signals to Monitor

- Treasury Bill Yields

- Sharp spikes indicate increased default concern

- Inverted yields near debt ceiling dates suggest stress

- Credit Default Swap Prices

- Rising prices indicate growing default risk

- Monitor relative movement versus other sovereign CDS

- VIX Index

- Levels above 20 suggest heightened market concern

- Sudden spikes might indicate good entry points for contrarian trades

Conclusion: Preparing for Opportunities

The 2025 debt ceiling crisis, combined with Trump’s return to office, creates a unique trading environment. While increased volatility brings risk, it also brings opportunity for prepared traders. Keep these key points in mind:

- Monitor political developments closely

- Maintain strict risk management protocols

- Watch for safe-haven currency movements

- Be prepared for quick market reversals

- Keep some powder dry for unexpected opportunities

Remember: Historical debt ceiling crises have always been resolved, but the path to resolution can create significant market movements. Stay informed, stay prepared, and most importantly, stay disciplined in your trading approach.