If you’re trading forex in 2025, you’re about to witness some major market moves. Let’s break down what’s happening in plain English and see how it might affect your trading decisions.

The Big Picture: America’s Winning Streak

Think of the US markets as that one friend who keeps winning at everything. For the past 15 years, the US has been outperforming other markets, and this trend looks set to continue in 2025. But here’s where it gets interesting for forex traders.

What’s Moving the Dollar?

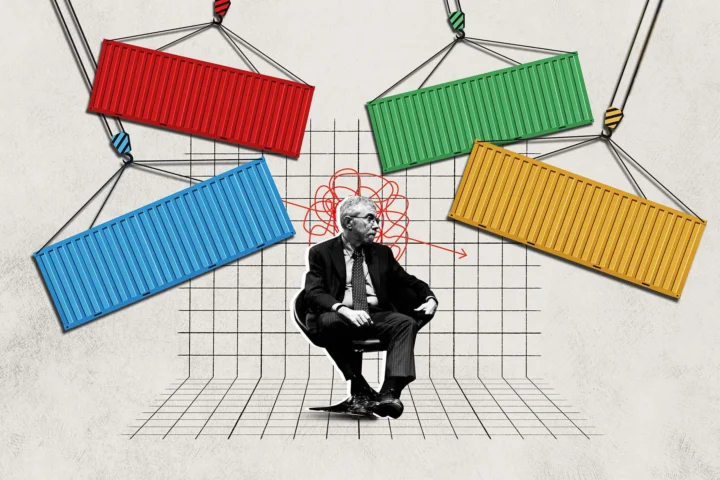

Trump’s Return: The “America First” Effect

- The USD is likely to stay strong as Trump pushes his “America First” policies

- Expect more talk about tariffs (taxes on imported goods), which typically makes the dollar stronger

- Tax cuts are coming, which usually helps US stocks and supports the dollar

Trading Tip #1: Watch for USD Strength

Keep an eye on USD pairs, especially EUR/USD and USD/CNH (Chinese Yuan). These could offer good trading opportunities as Trump’s policies kick in.

But Wait – There’s a Twist!

Here’s what could surprise traders and shake up your USD positions:

1. The Growth Gap Might Close

- The US economy might slow down a bit (less government spending)

- Europe could start catching up (their central bank might cut rates)

- This could weaken the dollar against major currencies

Trading Tip #2: Don’t Put All Your Eggs in One Basket

Consider keeping some positions in both USD and non-USD pairs to spread your risk.

Key Currency Pairs to Watch in 2025

EUR/USD

- Currently favoring USD strength

- But watch for surprise rebounds in European growth

- Key level to watch: Any major ECB rate cuts

USD/JPY

- Japanese Yen might strengthen more than people expect

- Japan’s central bank likely to raise rates higher than market expects

USD/CNH (Chinese Yuan)

- Likely to face pressure from trade tensions

- But watch for any surprise stimulus from China

Special Notes for Retail Traders

Risk Management Tips

- Keep position sizes reasonable – 2025 could be volatile

- Use stop losses consistently

- Don’t bet everything on USD strength continuing

What Could Go Wrong?

- Trump might be softer on tariffs than expected (to keep inflation down)

- Tech stocks might cool off (this affects overall USD strength)

- Other countries might start performing better than expected

Golden Opportunities

Gold might be worth watching as a hedge against:

- Political uncertainty

- Inflation risks

- Market volatility

Bottom Line for Retail Traders

While the USD looks strong heading into 2025, smart traders should:

- Keep positions flexible

- Watch for signs of change in US dominance

- Don’t ignore opportunities in other currencies

- Stay informed about Trump’s actual policies (not just his announcements)

Remember: The forex market loves to surprise even the most experienced traders. Always use stop losses and never risk more than you can afford to lose.